Yesterday, as Chairman of NZAMI, I attended the Prime Minister’s announcement of the overhaul of the Active Investor Residence programme. There is general agreement in the industry that this is a positive move, and it will probably revive what the Minister of Immigration has described as a “lame duck” policy. The new settings go live on 1 April 2025, but there will be a lot of activity in this space in the lead-up to that date. We won’t get the detailed rules about how it will work until March.

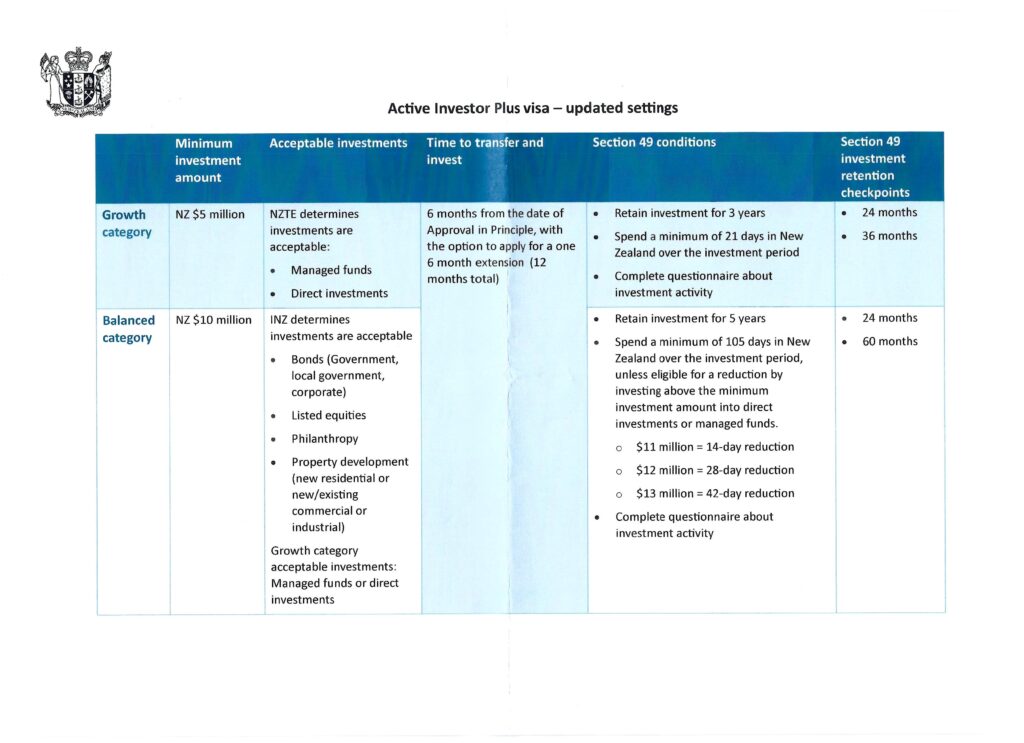

The summary above sets out the essentials of the new scheme.

Growth Category

This is a carry-over from the present Active Investor scheme, but applicants will now only have to keep their NZ investment in place for 3 years instead of 4 years. People who want to put their money in Managed Funds only have to meet the NZ$5 million minimum, instead of $7.5 million at present.

More controversially, successful applicants have to spend just 3 weeks in NZ during the 3-year investment period, or one week a year. This has been criticised for being far too light an obligation. There are a couple of things to think about here. First of all, where do we get the idea that someone who is putting a lot of money into the NZ economy already has to “do their time” like a prison sentence in order to earn the privilege of being allowed to live here? Secondly, from my own experience I can say that high-net-worth individuals who qualify for this sort of policy have interests and obligations all over the world. Having to make a 20- or 30-hour trip multiple times a year simply to get their time in is, in fact, a significant obstacle for some. Remember that we are about as far away from international centres of enterprise as it is possible to get. The entire purpose of this sort of so-called “golden visa” is to attract people, not turn them away.

Finally, let’s flip this issue on its head. There is an ill-formed idea out there that most investor migrants will do their minimum time, get the unconditional Permanent Resident Visa (PRV) at the end of the investment, and disappear with their NZ bolt-hole in a back pocket for a rainy day. Doesn’t this thinking simply reflect our national self-doubt? Why shouldn’t we be confident that, once people get a taste of spending time here, they will want to come back for more of the life and the vibe in Godzone Country, as we used to call it? That is exactly what investor migrants have been doing for years. While there are undoubtedly some who simply do just enough to get the PRV and then pull their money out, there are others who wind up investing far more into the country than the amount they had to stump up to get their visa.

Balanced Category

The second and apparently new part of the scheme is actually just a wind-back to the Investor 1 offering which was ditched in mid-2022, in favour of the failed experiment we have lived with for the past 2 years. This is the real good news of the announcement. It does require an up-front investment of NZ$10 million, but this only amounts to about US$6 million or 4.6 million Pounds at current rates. It is a policy that worked, in that it brought billions of dollars into the economy.

It allows investment in pretty much any class of asset which is “capable of a commercial return”, instead of the current restrictive model which forced applicants to treat only with investment vehicles curated by NZ Trade & Enterprise. The trade-off for this freedom is that visa holders must maintain their investments for 5 years, instead of 4 years at present. On the other hand, the time-in-NZ condition has been reduced from 117 days to 105 days spread over that 5-year period, which is 3 weeks a year.

English Language

Another major relaxation of the rules will be removing the need to prove English ability. Up until now, investors have had to prove that they speak some English. For those from non-English speaking backgrounds, this means sitting a test for IELTS or a similar system. One reason given for taking this out of the mix is that it is quite possibly insulting to expect wealthy and successful people of business (as many investors are) to go back to the classroom so that they can come to New Zealand.

Critics have pointed out that taking English out of the equation is unfair upon those who come to New Zealand to work and to strive toward Residence. They must all, at some point, prove a good command of English, whilst those with the money are let off the hook.

This reasoning is flawed because it ignores the circumstances in which these different groups come here. Those who have to prove English ability are applying for visas based on their employment. They have to be able to talk and write in English in order to do their job, to work alongside their colleagues, bosses and subordinates in the workplace. High-net-worth individuals, by definition, don’t have to do this. They are not required to be at the workplace day in, day out. If communication is an issue, they can afford to pay for good interpreters and translators – or use smartphone apps to do the same sort of thing.

The PM announced on Sunday that this initiative is further proof that New Zealand is open for business. So are we at Laurent Law. If you want to explore your ability to secure NZ Residence by investment, contact us for a time to meet.